Cell and gene therapies (CGTs) have the potential to revolutionize the treatment landscape and even cure previously incurable diseases. Optimism surrounding these innovative therapies is propelling a 46% compound annual growth rate over the next five years, bringing the total global market size to nearly $37 billion.

Yet given the high cost of the drugs, combined with smaller population sizes, early innovators still face significant issues securing reimbursement from payers which limits their ability to recoup investments. Ongoing funding challenges for health systems around the globe could further tighten reimbursement and add pressure to lower prices. At the same time, manufacturing and quality processes remain immature and non-standardized with low automation and high material cost, resulting in margin levels that test the commercial viability of the new product classes — both in cell and gene therapies.

Closing the commercial viability gap will be a key priority to successfully give large patient populations access to the great potential these therapies can bring. Our report, “Unleashing Success: Closing The Commercial Viability Gap In Cell And Gene Therapy,” details steps organizations can take to make greater progress on pricing and bring the cost of goods down to viable levels.

Cell and gene therapy — from science fiction to blockbuster drugs

Cell and gene therapy refers to the introduction, removal, or change in the content of a person’s genetic code to treat or cure a disease. This is achieved by either directly injecting genetic material into their bodies or using modified cells and (re)inserting those as the therapy. What was once an unimaginable leap in science has now become a reality for many patients.

Cell and gene therapies started getting regulatory approval in the mid-2010s. Since then, the number of annual approvals has been mounting, reaching 21 total approvals in the US and Europe as of early April 2024. Not only has the volume of therapies increased, but there have been many technological advancements within the therapies such as the approval of Casgevy in December 2023 which is the first therapy approved using CRISPR gene editing.

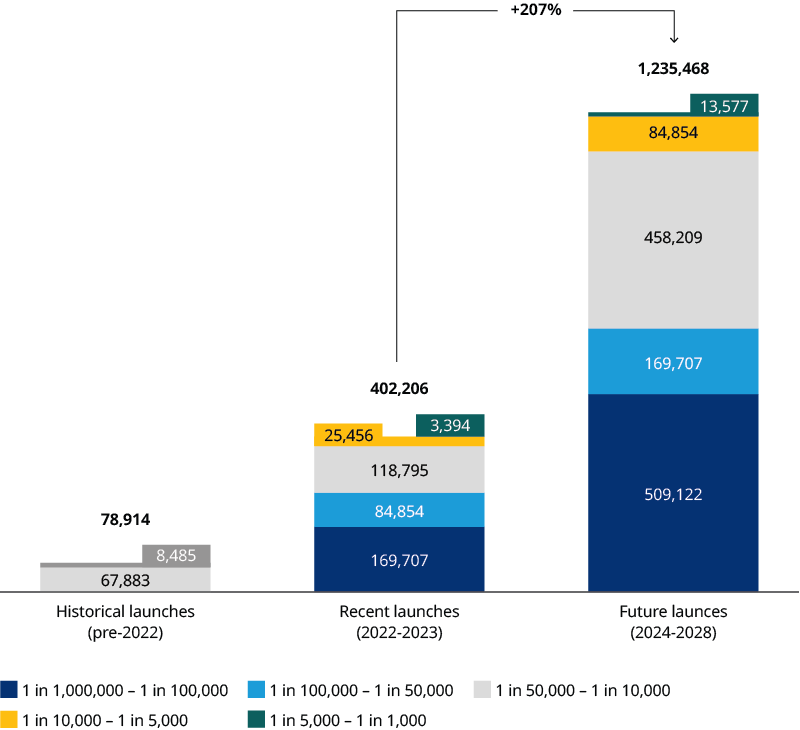

To date, two CGTs have reached blockbuster status: Zolgensma and Yescarta. This will likely increase to six by 2028. Taking late-stage pipeline candidates into account, the potential addressable patient population magnitude is forecasted to increase by more than 207% by 2028. This is driven by both a larger volume of CGTs entering the market and expansion into such larger indications as systemic lupus erythematosus (Exhibit 1). As a result, CGTs are becoming a common therapeutic class with applications across millions of patients globally, expanding beyond the traditional utilization for ultra rare diseases.

Still, the commercial viability of CGTs remains uncertain. Securing reimbursement and improving operating margins are both looming challenges ahead for sustaining the future of CGT's commercial success.

Securing cell and gene therapy reimbursement

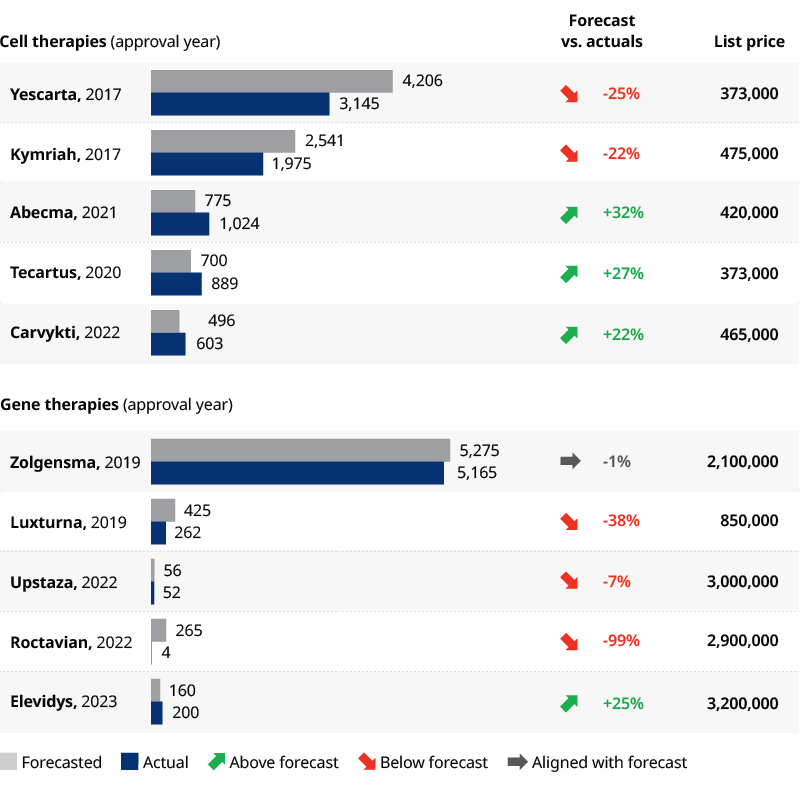

Despite the scientific success and advancements, most CGTs have fallen behind analysts’ revenue forecasts. Reasons for the shortcomings include:

- Approval delays: For example, Roctavian was initially rejected in 2020. Then, the Food and Drug Administration added a three-month delay in 2023 to review additional data before granting final approval in June of that year

- Supply constraints: Yescarta and Kymriah and other CAR-T therapies, for instance, have been thwarted by supply chain and manufacturing challenges

- Reimbursement: Unfavorable reimbursement forced Bluebirdbio to pull Zynteglo out of the EU, resulting in the suspension of all European operations and the withdrawal of their initial CGT product, Skysona

The most striking shortcoming came this February when BioMarin announced its 2023 revenues for Roctavian at $3.5 million. This was far below their internal target of $50 million-$150 million for 2023 (Exhibit 2).

Why price remains the biggest challenge in cell and gene therapy

Beyond the extenuating circumstances mentioned above, price remains the one universal challenge impeding the widescale adoption of CGTs. It seems every year, a new CGT hits the most expensive drug record. The skyrocketing prices of CGTs, which accrue at once due to the one-off nature of CGT s, place immense pressure on payers making reimbursement securement challenging. As CGTs move into the mainstream treatment landscape, the need to commercialize via a sustainable model will be necessary.

Outcome-based agreements (OBAs) have been explored as a potential vehicle to secure CGT reimbursement while providing affordability relief to payers. However, the OBA landscape remains fragmented with agreements being reached at individual product-country levels, but not yet achieving widespread coverage. Furthermore, there have been stark discrepancies across countries’ readiness and willingness to adopt OBAs. European countries, particularly Italy, have been early adopters of OBAs even outside of CGTs. Change may be coming in the US in 2025 when the Centers for Medicare and Medicaid Services launches a pilot program testing a new access model for sickle cell disease under Medicaid. More than 100,000 people in the US, most of whom are Black, have the genetic disorder. CMS will support states in negotiating and executing OBAs. Fostering collaboration across stakeholders, including setting up the necessary infrastructure to enable OBA like patient data registries will be the key to reliably securing CGT reimbursement in the future.

Improving operating models in cell and gene therapy

Another barrier to CGTs achieving sustainable commercial success is the slim operating margins. Cell therapy commercial viability largely depends on reducing manufacturing costs through cost of goods sold (COGS) optimization. For instance, autologous CAR-Ts have dominated the gene modified cell therapy market but unless the costs are reduced by at least 50%, therapies are unlikely to be commercially viable and their growth potential will be limited. Allogeneic cell therapies have been explored as a more cost-efficient off-the-shelf alternative. Nonetheless, allogenic therapies are not truly scalable either and only represent about 25% of gene modified cell therapies in the pipeline. Therefore, autologous cell therapies are here to stay and the need for improved manufacturing via personnel, capital and material cost optimization throughout the value chain cannot be ignored.

In contrast, the main challenge facing gene therapies is recuperating large research and development capital expenditures from small patient populations. Gene therapies are highly complex with long lead times rendering them expensive investments. Meanwhile, gene therapies are typically indicated for rare diseases, meaning patient populations are small and often hard to identify. Furthermore, given the curative nature of gene therapies, the total addressable patient population declines with every patient treated. Manufacturers therefore are at an increased risk of not making a return on their investments. The most predominant bottleneck in improving development cost effectiveness lies in improving viral vector manufacturing techniques.

The scientific and clinical progress of CGTs has accelerated tremendously in the last decade, however, manufacturing technologies need to advance at an equal, if not quicker, pace and to avoid falling short of commercial success.