Despite the challenges and recessionary pressures, European industrial goods companies are exhibiting strong performance, with confidence shared by executives and equity analysts alike. However, "mixed realities" are evident, with performance varying significantly across sub-sectors. Moreover, accelerated transformation is reshaping both companies and the industry.

Our report “The State of the Industrial Goods Sector 2024: Value growth, mixed realities, and concerns about Europe” offers an in-depth analysis based on extensive studies of 1,300 listed industrial goods companies worldwide, a survey of 170 European executives, 20 CEO and CFO interviews, and our experience as trusted advisers to the industry.

Solid sentiment and value growth in the European industrial goods sector

Even with recent headwinds from global demand weaknesses and market uncertainty industrial executives maintain a solid level of confidence. However, compared with our 2023 report, feedback reflects more tempered optimism, with concerns over weak order intake and adverse political developments. The sentiment varies strongly depending on the markets served.

It is hot and cold at the same time, with defense, power generation, electrification, and semiconductor being hot, and automotive, chemicals, and construction being coldCEO of a global producer of special metals

It is hot and cold at the same time, with defense, power generation, electrification, and semiconductor being hot, and automotive, chemicals, and construction being coldCEO of a global producer of special metals

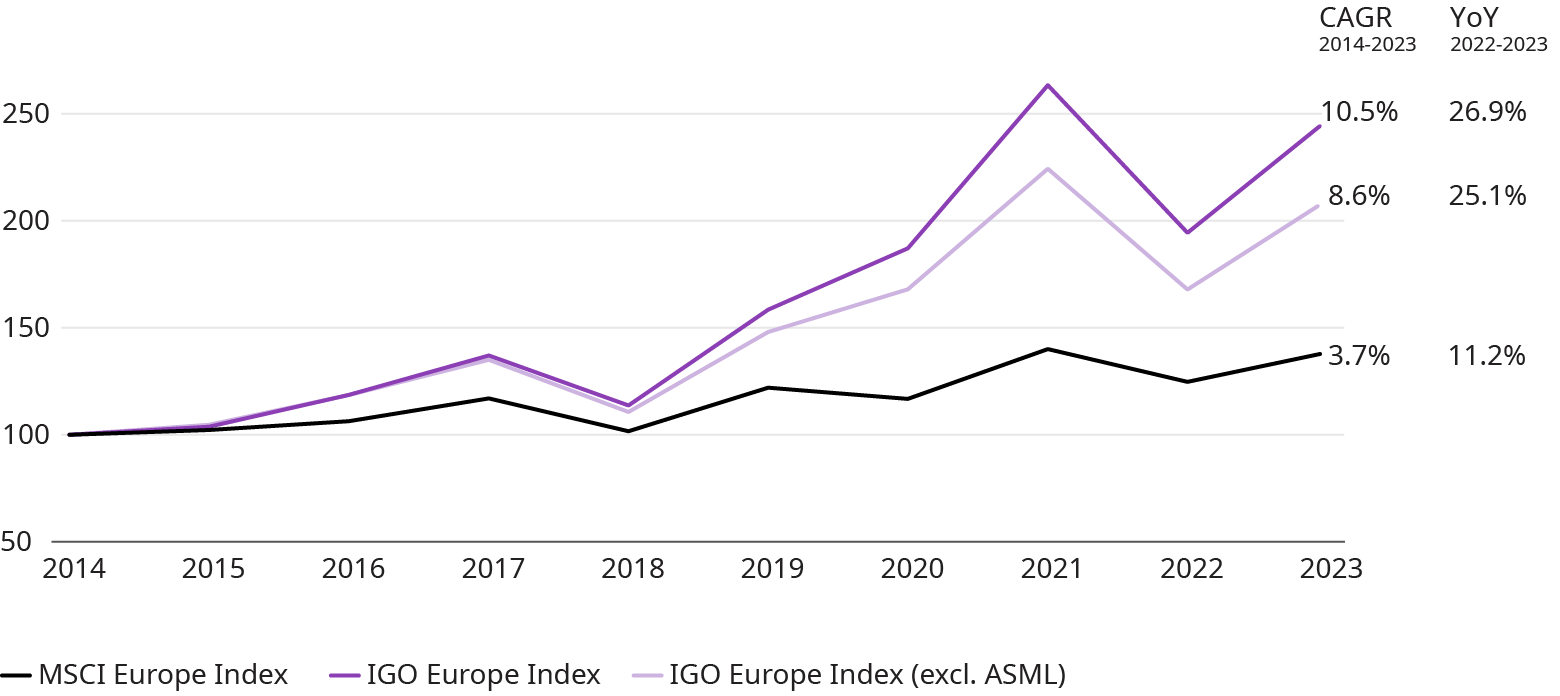

The industrial goods sector continues to generate significant value, outpacing many other business sectors in Europe. The Oliver Wyman Industrial Goods (IGO) Europe Index has shown a 6.8 percentage points higher annual value growth than the MSCI Europe Index since 2014. Following a period of weakness in 2021-2022, value growth rebounded, surpassing the MSCI Europe by 15.7 percentage points in 2023. Notably, semiconductor equipment supplier ASML contributed to this growth by 1.8 percentage points, and alone represented a whopping 19% of the index’s total value. Even excluding this company, the sector’s value growth remains strong, reflecting sustained investor confidence.

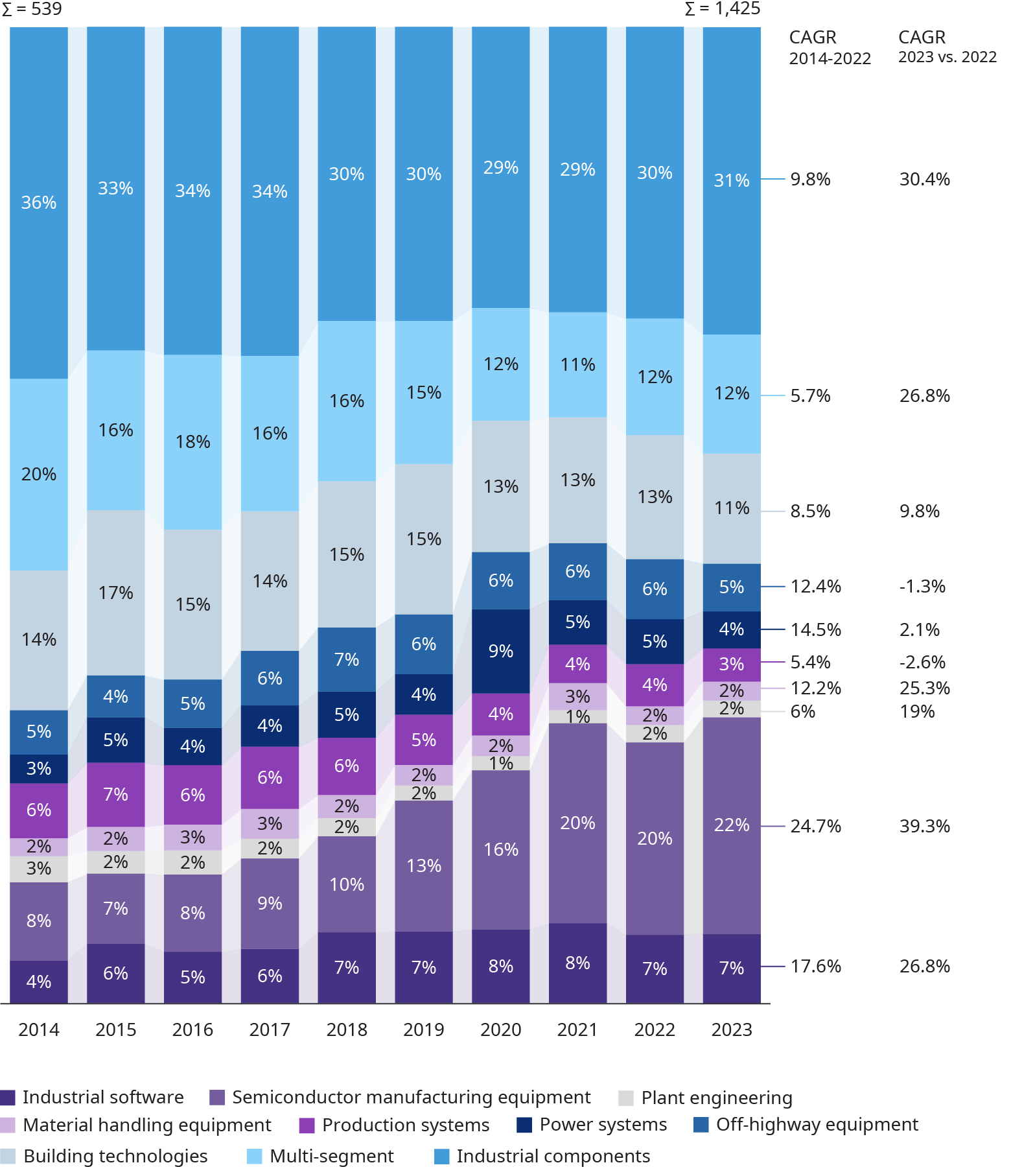

Industrial goods value shifts across sub-sectors and regions

Value developments vary significantly by sub-sector. Software and semiconductor-related businesses continue to rise, while off-highway equipment and production system original equipment manufacturers (OEMs) struggle with slow end markets. Overall, megatrends are driving value, and companies in relevant sectors have an edge.

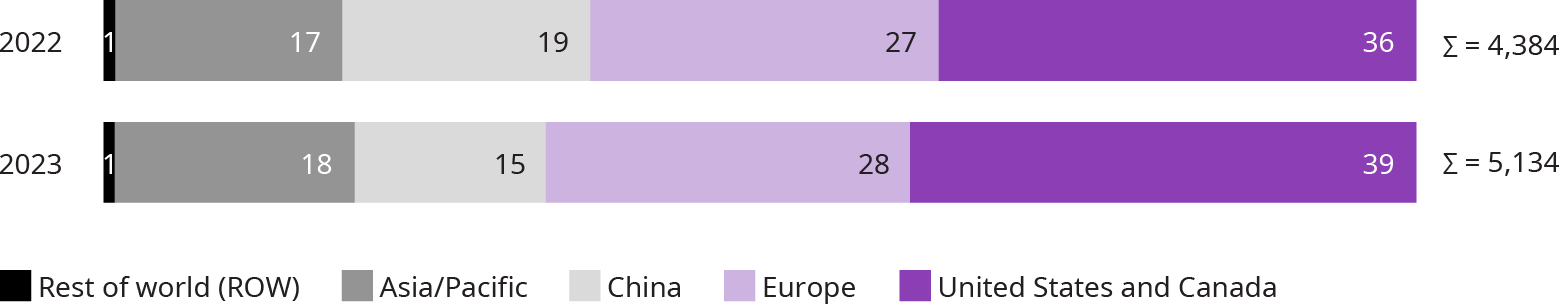

Regional variations also exist, with favorable conditions in the US driving a value shift to North America. Chinese firms saw a decline in value, losing over €80 billion year-over-year, while European industrials managed to maintain their share despite negative press and political headlines.

Key concerns for CEOs in the industrial goods sector

CEOs in the industrial goods sector express significant concerns over escalating geopolitical tensions and recessionary risks in many European countries. These worries are compounded by a noticeable decline in order intake across various sub-sectors and persistent economic uncertainties, particularly regarding China. Supply chain bottlenecks, once a major issue, have nearly vanished, dropping in priority from the second-most pressing concern to eighth.

In 2024, executives see the greatest opportunities in honing core competencies and developing green technology products, reflecting a cautious approach to risk. They also view expansion into new markets such as Southeast Asia, India, and the Middle East as crucial. At the same time, enthusiasm for digital business models and mergers and acquisitions has waned considerably compared with the previous year.

High analyst confidence in the industrial goods sector

Most industrial executives remain optimistic about revenue and earnings before interest and taxes (EBIT) growth, though confidence has waned slightly from last year. This sentiment is shared by equity analysts, with 74% recommending “buy” or “outperform” for European industrials, an all-time high. This surpasses the average across all sectors.

Focus topic — ensuring international competitiveness in the industrial goods sector

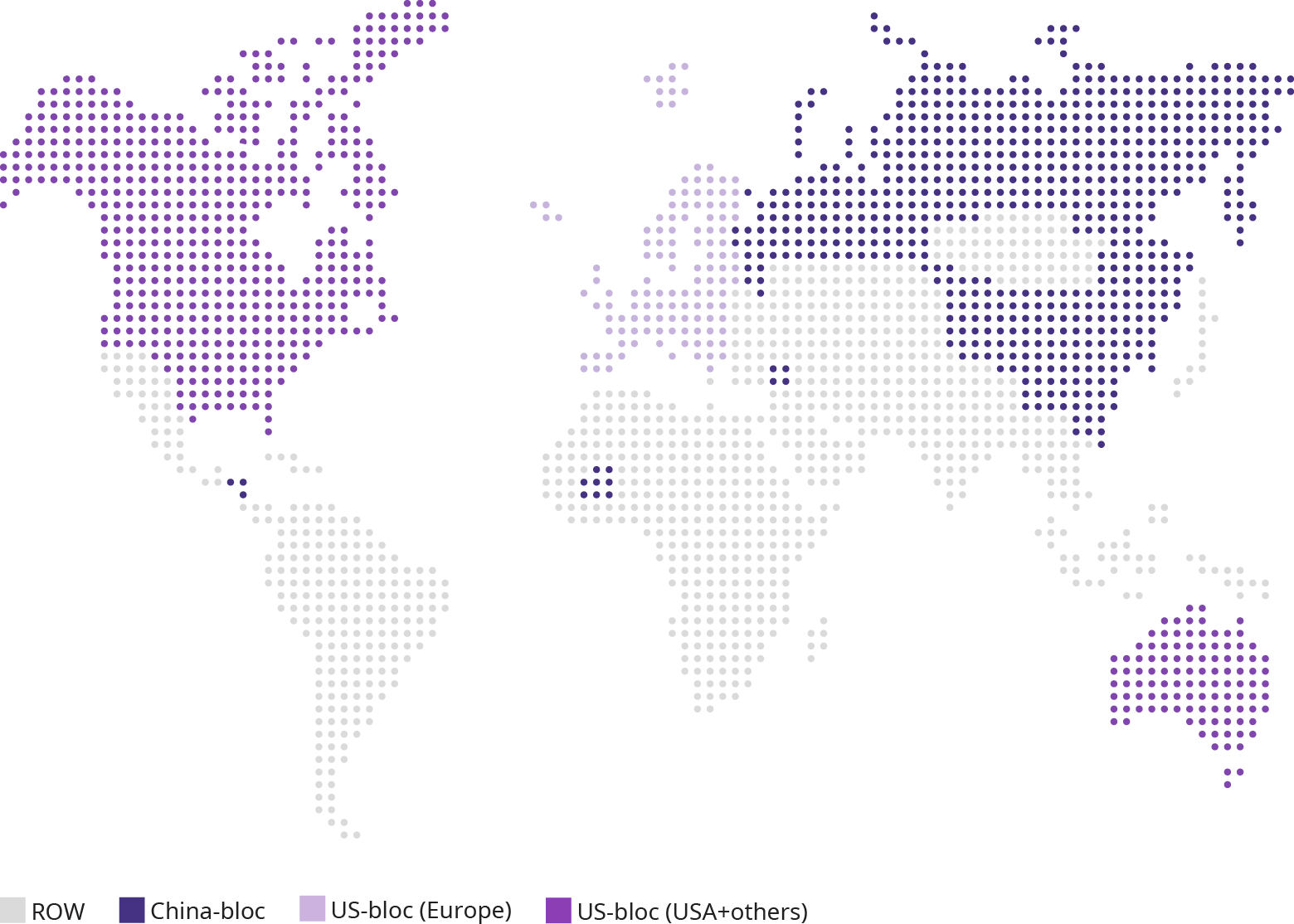

European industrial goods companies are facing significant pressures from geopolitical and economic factors. CEOs express deep concerns over deteriorating business conditions in Europe, citing high labor costs, skilled labor shortages, and excessive regulation. Meanwhile, conflicts, especially between the US and China, are reshaping market accessibility and cost positions. Chinese manufacturers, facing a stagnant domestic market, are increasingly targeting international markets. Half of our survey respondents report high pressure from Chinese competitors. However, the real competitive battlefield lies in “neutral” countries, which collectively receive nearly 50% of Chinese industrial equipment exports.

To enhance competitiveness, European companies need to take strategic action. Three common areas of action emerged in our analysis:

Improve operations at home

Companies should pursue entrepreneurial solutions over political reliance. Key strategies include reducing costs, enhancing automation, and fostering innovation.

Shift manufacturing footprint

Manufacturing is being shifted to countries with lower costs and better labor availability than Western Europe, such as Poland, Bulgaria, Romania, and Serbia. Outside of Europe, countries like India and Southeast Asia offer lower costs, attractive business conditions, and access to high-growth markets.

Rethink global operating models

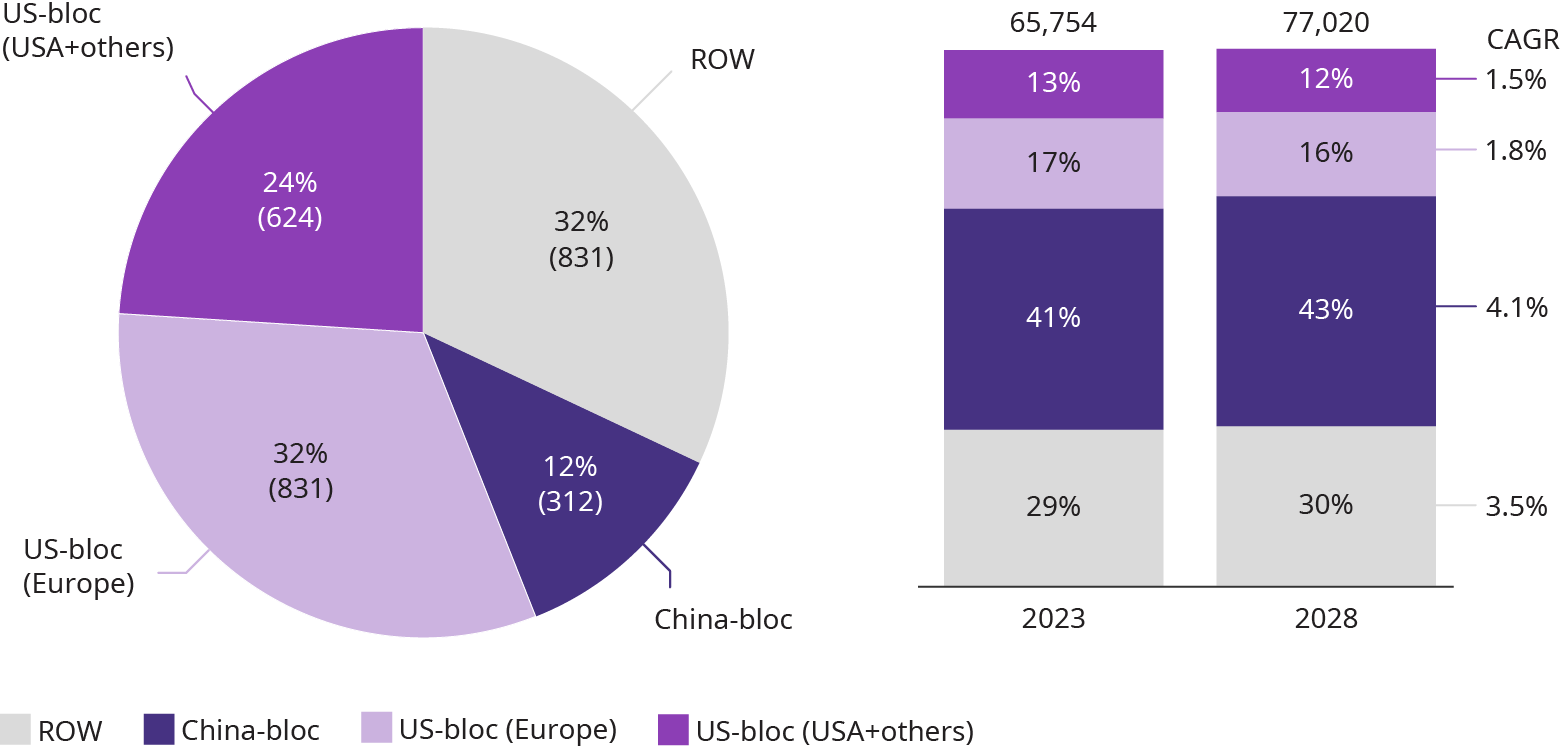

Despite some recent risk mitigation measures, many European industrial goods companies lack a clear strategy for competing in a world divided into China-led, US-led, and neutral spheres. To avoid losing market share, smaller companies may need to stick with a European-based export model, effectively relinquishing the China-led sphere and competing in neutral countries. Companies with complex products might benefit from having two or three international hubs, including one in China.